We always get asked all the time “which accounting software should I learn, Xero or MYOB?”, or “which one is the best accounting software?” and so on.

The answer is quite simple. You need to learn both.

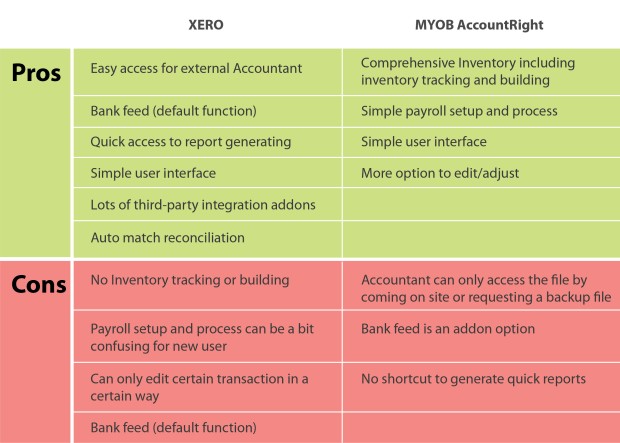

Why? Because your employers use either of them with their personal choice. Therefore, to make sure you are job ready, you will need to learn both. The fortunate thing is that they are not too much different! In this newsletter, we summarise some pros and cons of MYOB and Xero.

MYOB

MYOB has many different versions, and MYOB AccountRight is the most widely used in the industry. It is a desktop base accounting program so you can only access the accounting information form that computer. MYOB is the favourite of small business, as it enables the non-technical people to complete the daily accounting tasks more efficiently. It is also much easier to use with its flow chart of icons in each divided section guiding you what to do next.

Xero

Xero is getting trendier these years; it is a cloud base accounting software which focus more on accessibility. Therefore, allowing anyone with the authorised login credential to access the accounting information from anywhere with internet access. Making the interface as plain and neat as possible giving you an overview of the business performance once you are logged in. Such as bank account balance, how much bills your company had paid and needs to pay, and how much the sale you have received or need to collect.

And the winner is…

Personally, I like both of them. They both have their ups and downs and they both can pretty much do the same tasks as one another. So, depending on the type of business you are working for, you will choose the ones that has the slightest advantage. E.g. if your business deals with lots of inventory / stocks then you would be better off with MYOB.

As you don’t know who you will end up working for and which accounting system they are using, learning and understanding both software’s will help cover this gap and make things much easier for your future employment. You might even persuade the new employer to change their accounting software to a much more efficient one base on their business requirement.