What is a Journal Entry?

A Journal entry is the transaction of each recording that is entered into the accounting system to show the debits and credits of that entry. Nowadays, when recording business transactions, you won’t see the debits and credits entry as everything is done behind the user’s interface automatically. All accounting software have manual journal entry recording function. This helps businesses move and correct their internal ledger accounts, such as inventory stock adjustment, accrual reversal transaction, prepayment allocation, etc.

In this article, we’ll show you how to gain access to the manual journal entry function using MYOB, Reckon Accounts, and Xero. You will notice that some software can provide an easy access than others.

And besides, our MYOB, Reckon Accounts, and Xero programs are always available for you to upgrade your skills and boost your career to the top of the Accounting mountain! Check out each program here and APPLY NOW to get the best deal:

In this particular case, we will be doing an inventory stock adjustment.

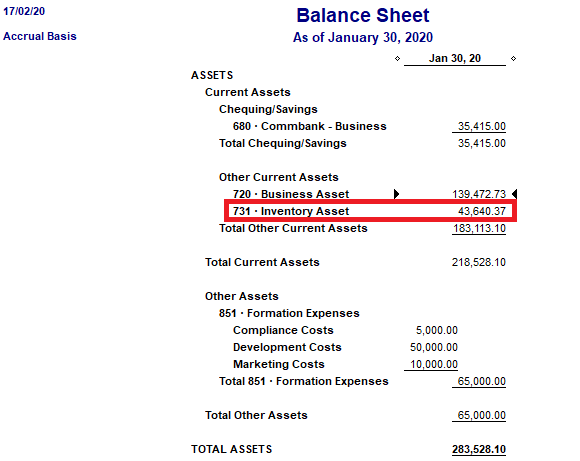

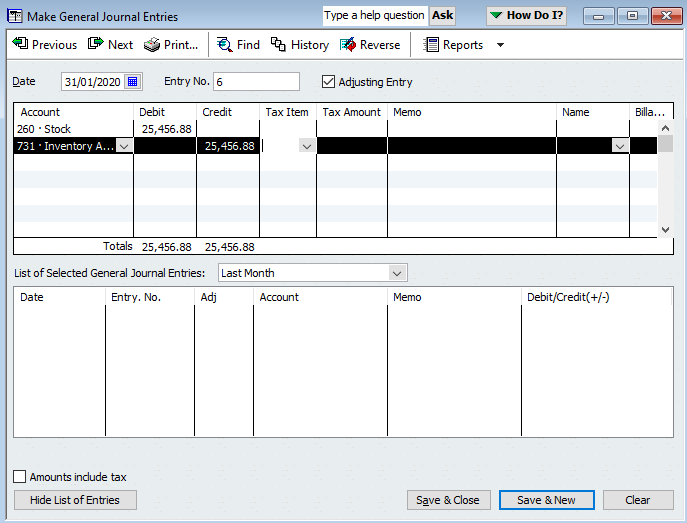

At the beginning of January 2020, you had an opening stock of $43640.37 (36 units of stock at $1212.2325 each GST excl). On the 31/1/2020, you had a stock count and noticed there were only 15 units on hand. After doing a sales/inventory reconciliation you concluded that: 21 units were sold during January. As you hadn’t used the inventory tracking system, the recording of your sales was not updated to your inventory account. Therefore, you will need to do a manual journal entry to reflect this update.

Below are the steps to locate and perform a manual journal entry. Assuming that all accounts are relevant.

1. Open the MYOB program. Then open your business file.

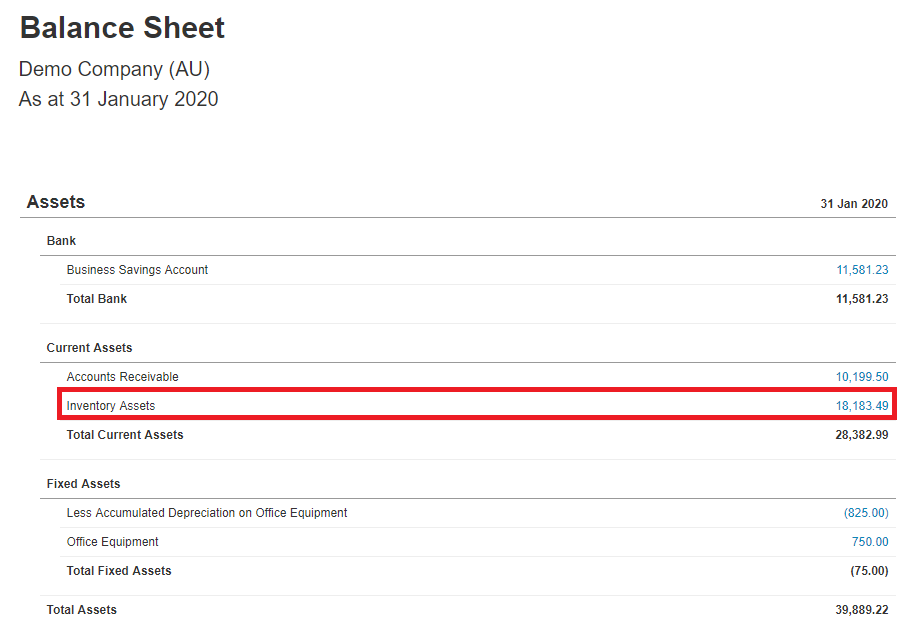

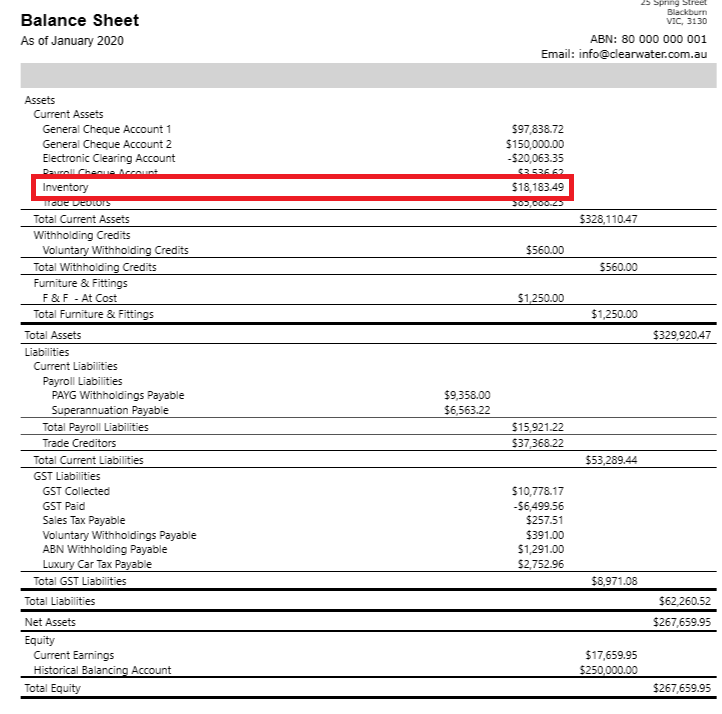

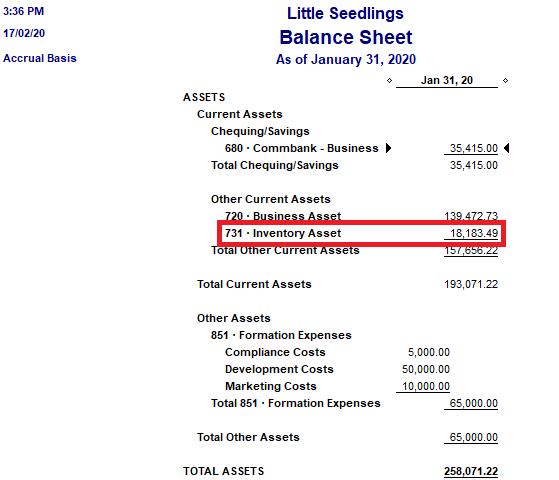

2. Run the balance sheet report for the relevant period, you should see the inventory balance.

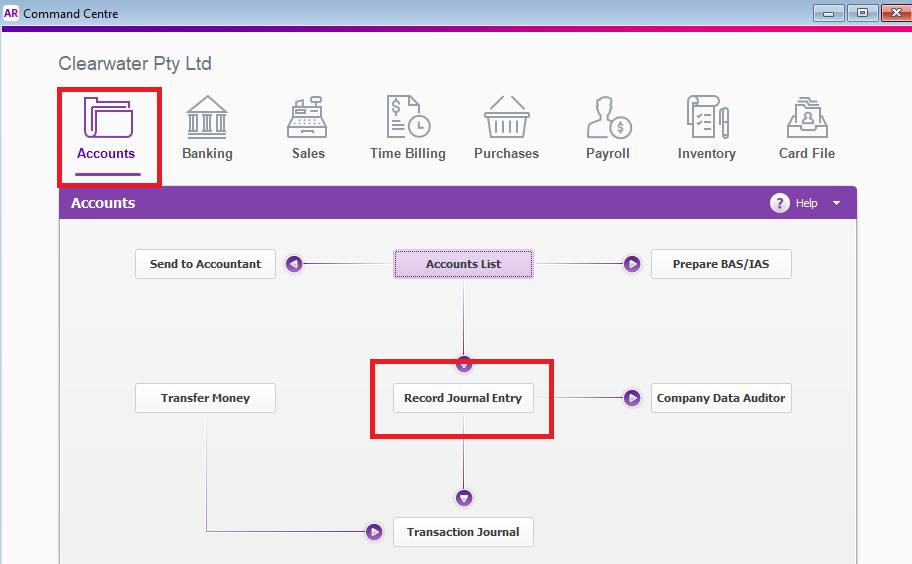

3. Go to the Command Centre and click on the Accounts tab, then click on Record Journal Entry.

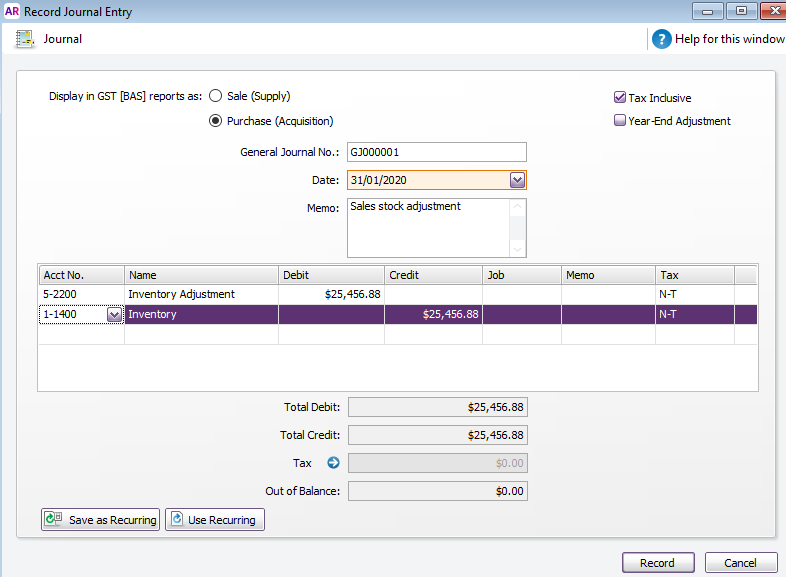

4. In the Record Journal Entry window, fill in the journal date, memo, select the two accounts for this entry (5-2200 Inventory Adjustment – Cost of sales account, 1-1400 Inventory – Asset), and allocate the debit and credit. As this is an internal adjustment no tax is involved.

5. Click Record to make the adjustment.

6. Go back to your balance sheet report and run the reports for 31/1/2020. You will now see that the Inventory account has been adjusted accordingly and you now have 15 units ($18183.49) worth of stocks left.

1. Open Reckon Accounts and select your business file.

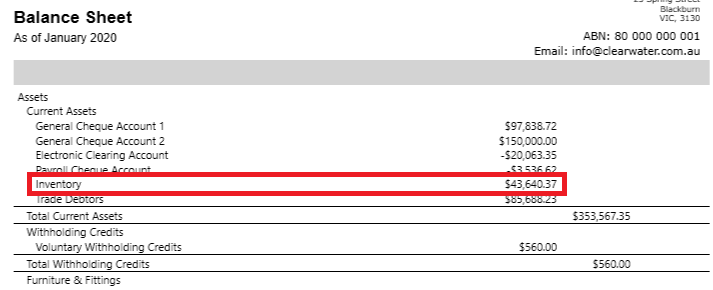

2. Run the Balance Sheet to check the current balance of the Inventory account.

3. As you can see the amount is the same as our current opening stock, so we need to adjust this to match your stock takes at the end of the month.

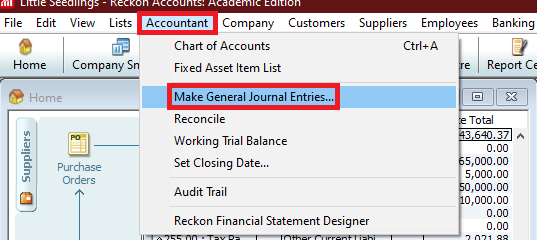

4. At the top of the program click on the Accountant tab, then Make Journal Entries…

5. In the Make General Journal Entries window, fill out the required field. E.g. Date, Accounts, Debit and Credit then click on Save & Close.

6. Run the Balance Sheet report again to see the adjustment.

1. Log in to your Xero account.

2. Go to the Accounting tab and open up your balance sheets. You should be able to see your inventory account and its balance as of the date provided.

3. As you can see the amount is the same as your current opening stock, so we’ll need to adjust this to match your stock-takes at the end of the month.

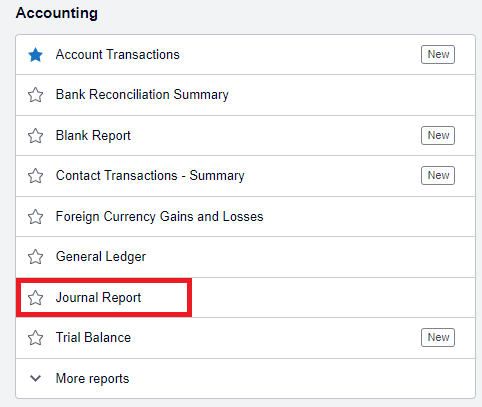

4. Then click on the Accounting tab and select Reports. Scroll down to the Accounting section and click on Journal Report.

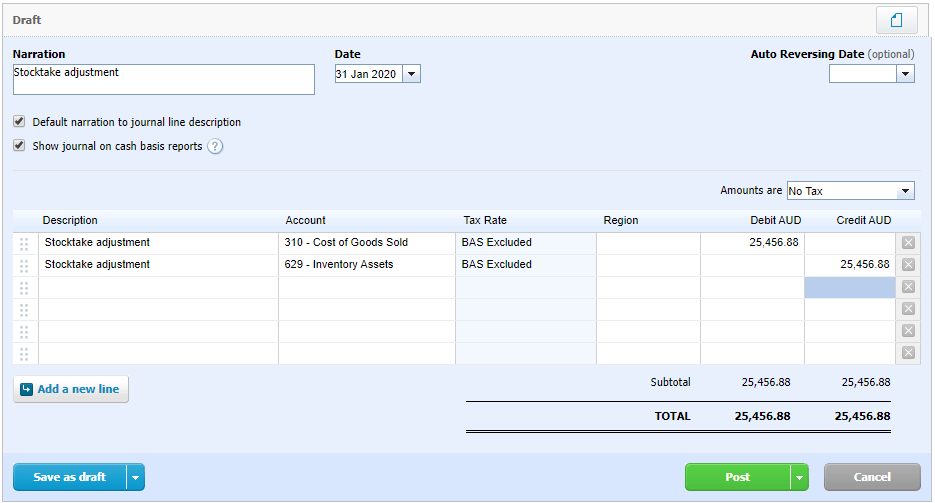

5. In the Journal Report, click on + Add New Journal. Fill in the required fields. Click Post to make the adjustment.

6. Finally, go back to your Balance Sheet and you’ll see the adjusted stock-takes.